How the Great Depression Shaped Stock Market Regulations?

Author: sana

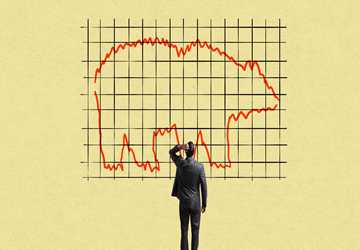

Have you ever wondered how the stock market became the regulated system we know today? The Great Depression, one of the most severe economic crises in history, began with the 1929 stock market crash in America.

As the nation grappled with unemployment, bank closures, and economic instability, it became clear that the largely uncontrolled stock market had played a significant role in the crisis.

This realization led to the formation of the Federal Reserve System and a complete overhaul of America's approach to financial regulation and supervision.

In the aftermath of the Depression, policymakers and legislators worked to establish a more stable and transparent financial system. The resulting reforms profoundly influenced the stock market.

These changes, born from economic turmoil, laid the foundation for modern securities regulation and continue to shape our current market practices.

This article will explore the essential standards that emerged during the Great Depression and their lasting impact on the American financial system.

The Regulations of the Stock Market

Try to imagine the stock market being turned into a total anarchy. Sounds exciting, right? But it is also a recipe for disaster. That's why rules matter.

Looking at stock market regulations, one may refer to them as the referee in a sports match. They prevent fakers from spoiling it for the rest of the players and keep things balanced.

First, they protect us, the ordinary people who invest money. They ensure that large companies do not con us or take our hard-earned money.

They also help maintain a steady market. Without them, the prices could fluctuate depending on rumors or with the help of specific manipulations. That is different from how an economy should be managed.

Lastly, regulations build trust—investment results from a perception that the system is fair when people deal with it. More investment is suitable for everyone and, therefore, strengthens the economy.

Good rules consistently enhance the market's health. They are not flawless but far better than any other option.

Key Reforms Introduced After the Great Depression

During the Great Depression, most people realized that significant alterations were necessary to continue their lives. The government needed to be more active and expect things to recover independently.

Thus, it started working without wasting more time and created a package of reforms that changed the face of Wall Street for several decades.

Let's dive into the big moves that changed the game:

1. The Securities Act of 1933: Bringing the Spotlight on Wall Street

The Securities Act of 1933 was akin to switching on a light at a party that was previously full of vices. It compelled many firms to reveal their balance sheets before floating shares. No more burying the ugly part in the small letter.

This law ensured that people who were not experts could get lucid information on the investments. It was not all rosy, but it was the best shot at dismantling the structures that gave men an upper hand.

2. The Securities Exchange Act of 1934: Building the guardian of the market

While the 1933 Act may have been about truth, the 1934 Act was about keeping an eye on things. It created the SEC, which is like the police force of the stock market.

The SEC was granted the authority to penalize rule violators and regulate stock exchanges. This was like giving a referee a whistle and permission to blow it.

3. The Glass-Steagall Act: Dividing the World of Money

Glass-Steagall was like saying to a man who wanted to be all things to all people, 'Now choose what you want to be.' It forced banks to choose: they had to choose between being a regular bank and an investment bank, but they could not be both simultaneously.

The idea is to prevent banking institutions from speculating with people's hard-earned money. Although many people do not like it, it did help put some order into the banking industry for several decades.

4. Regulation T: Putting the Brakes on Borrowing

Regulation T was all about cooling down the hotheads. It restricted the amount people could borrow to invest in stocks. That is the end of betting on a 'sure thing' as a way of perceiving and handling life.

This rule was intended to cease the reckless practices that contributed to the 1929 crash. Shawn summarizes that it was like giving investors a smaller shovel to dig themselves into a hole.

5. The Public Utility Holding Company Act of 1935: The Power Giants, Tamed

This lengthy act was directed toward large utility organizations. It unbundled the companies and stopped their recklessness regarding people's electricity bills.

The intention was to regulate these vital services to offer consumers an equal chance at business success. It was like telling the schoolyard bully that he could not continue to collect everyone's lunch money.

Understand and Appreciate Regulatory Reforms

The stock market cannot be perfect, but it is very different from the situation in the early 20s. Many of those old reforms are still reflected in how we invest today.

The next time you complain about too many rules, think about the Great Depression. Those regulations were not implemented for fun but to ensure your and my safety.

Well, what does all of this mean for you? Stay curious. Find out what applies to your investments. Knowledge of them can help you be wiser in handling your cash.

So, there's always a way; remember, knowledge is power. The more one is aware of the existing market regulations, the better one's position in the business world.

Frequently Asked Questions

Q: What triggered the Great Depression?

Ans: The 1929 stock market crash was the spark that lit the fuse. However, a series of problems, such as overproduction, weak banks, and global economic issues, turned it into a full-blown crisis.

Q: Why was the SEC created?

Ans: Think of the SEC as the stock market's sheriff. It was set up to keep Wall Street honest, protect regular folks' investments, and ensure everyone plays by the rules.

Q: What is the Glass-Steagall Act?

Ans: Glass-Steagall was like a financial firewall. It stopped banks from using your savings to gamble on risky investments. The idea was to keep regular banks and investment banks separate.

Q: How do stock market regulations protect investors?

Ans: Regulations are like the guardrails on a mountain road. They help prevent fraud, ensure companies tell the truth about their finances, and keep the market from falling.